There are many profitable traders making good money who don’t run back-tests in a software and just organizing charts screenshots with their marks. However, the technology is available, and more and more bright minds are using it to their advantage. If you can incorporate these two edges into your trading training framework, you can become more effective in:

- Testing your ideas

- Internalizing market structure and patterns

- Finding the best opportunities in a marketplace

- Adjusting to constantly changing market conditions

These will shorten your learning curve and will make you a better trader.

Write Indicators/Filters

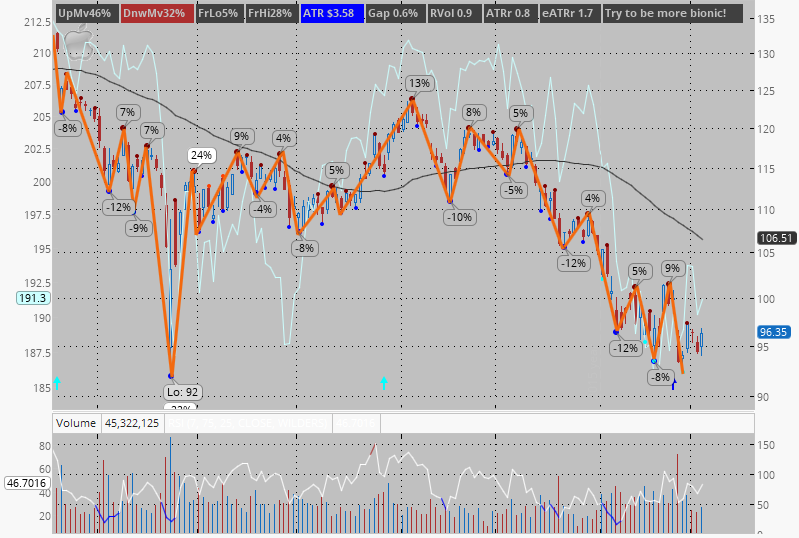

Use software to spot more of the best setups in the marketplace, streamline your decision-making process, and enhance your preparation. Nowadays, trading terminals and charting packages are highly advanced for these needs, often featuring built-in programming languages (usually with easy syntax) that allow you to make the software do whatever you like. You just need some time and perhaps some guidance. Customize your software to improve your craft—make it work for you! At the very least, try to output something on the chart, no matter how basic. Start by studying how other indicators/studies are written, and copy-paste blocks from there. It’s like learning a foreign language—perhaps even easier. Learn reserved words to define variables and perform arithmetic, and then think in terms of “if-then” statements if you need advanced functionality. Thinking in terms of “if-then” statements is a valuable skill for developing trade plans as well.

If you don’t want to code your ideas from scratch, you can hire a programmer/quant. Ask them to comment on all lines of the requested code so you can easily add, delete, or modify it later by referencing their notes. Returning to the idea of leveraging technology to improve your trading, here are some thoughts to keep in mind:

- Think what indicators (studies) you can write to spot more of your best setups

- Add a column with your indicator to your watchlist and sort the list by that column to prioritize the best ideas

- Create a pre-market indicator to sort your watchlist before the market opens, helping you identify the best potential trading vehicles for the day ahead

- Build a grid of charts and add your indicator to each chart so it notifies you when conditions are met (consider adding a sound alert for better functionality)

- Add a column with your indicator to your watchlist and sort the list by that column to prioritize the best ideas

- Think about how your terminal/charting package can help you visualize information:

- What information (labels) do you want to see on the chart (both longer-term and intraday)? Consider highlighting labels if certain conditions are met.

- How can the software highlight the market structure for you to help you internalize patterns more quickly?

- How can the software highlight the profit target area for your trades?

Backtesting

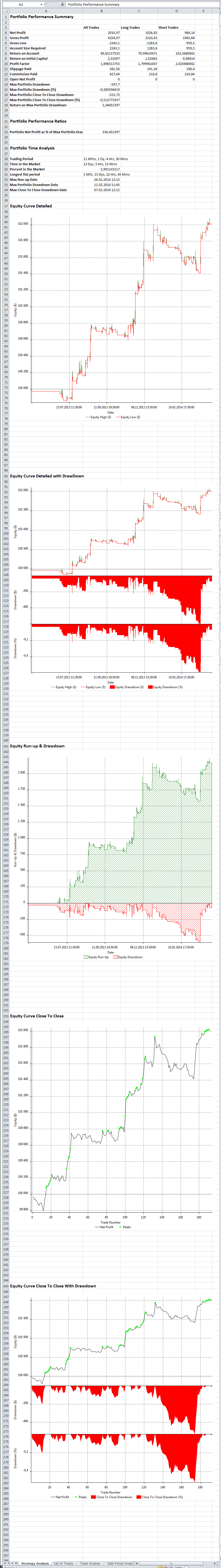

Backtesting is the process of testing a predictive model using historical data. How do you know you have positive expectancy over a large sample size of trades when you are just starting to trade? There are two ways to gain an edge here: by learning from a trader showing positive results and by backtesting your own ideas. Ideally, you combine both. Start by watching your mentor, but over time, you’ll likely come up with questions—what if I trail stops a bit differently? What if I initiate my position a bit earlier? A good mentor will encourage you to backtest if they don’t have a clear answer to your questions. It’s much faster to backtest your ideas than to forward-test them through paper trading. Backtesting software often includes “easy language syntax,” and you can find hundreds of code examples on developer resources to copy-paste and modify as needed.

Additionally, backtesting software usually has an optimization option. This allows you to define several variables within certain ranges and let the machine test all possible combinations. For example, if you have three variables, each with three possible values, you need to run nine backtests. For backtesting software, that’s effortless, whereas it would be very challenging to achieve the same manually through paper trading.

How a good PnL line and other parameters should look like?

This depends on your trading style. If you are a systematic trader, the statistics should be carefully examined. Many discretionary traders, however, take a hybrid approach by “applying some discretion to backtested observations” and “waiting for an indicator with a backtested edge to set up a trade based on their thesis.” In summary, backtest your observations and analyze market data to identify markers that provide additional value to your edge!

gl hf