Momentum indicator is a generic term, it embrace all different indicators like RSI, MACD, Stochastic, ROC and others. All of them have the ability to show divergences and you can draw overbought/oversold lines on many of them. Following principles we will discuss here can be applied to all of them, no matter which indicator you are using. Also you need to understand that momentum indicators can’t trigger the trades, you have to have confirmation from market structure to make a trade, but momentum indicators add value by telling us when the underlying technical structure is weakening or strengthening.

Overbought and Oversold

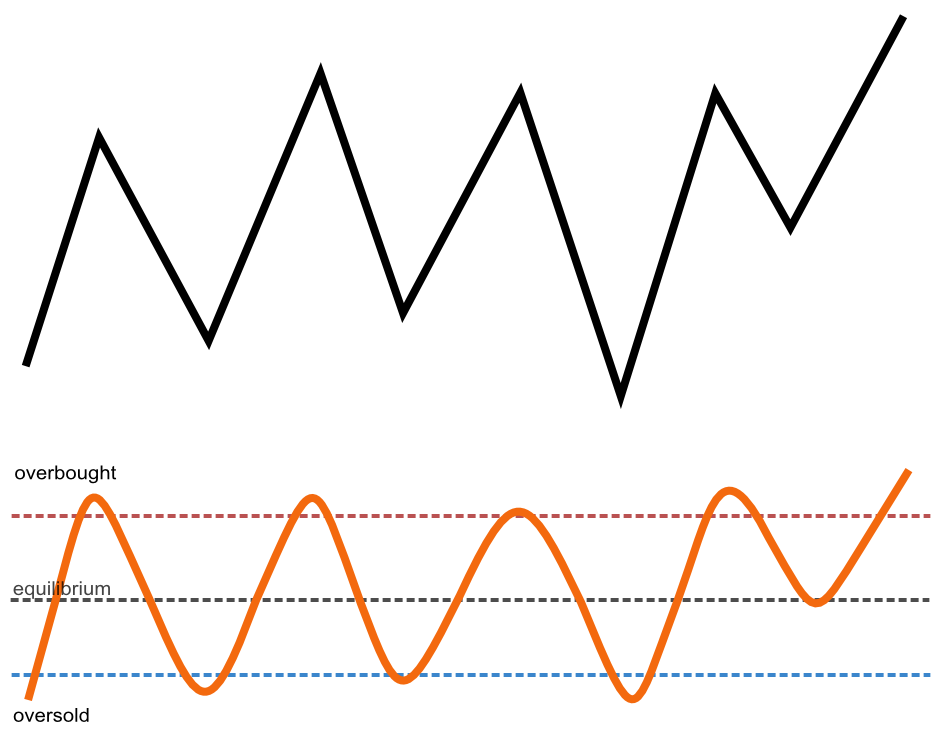

As you already know, all markets move in cycles because markets are generated by humans, and price reflects the hopes, fears, greed, and other emotions of all market participants. This means a market is a living organism like we are, and just like us, the market has its “breath.” Momentum indicators can help us analyze this breath and its shifts due to oscillation in a rhythmic way, and overbought/oversold lines help us identify reference points.

You try to draw these overbought and oversold levels with that idea of a breath. Feel your own breath—you kind of know when you’ve finished your inhale or exhale, don’t you? If you could plot a chart where Y is the air volume traded by your lungs and X is time, you would easily draw these overbought and oversold levels. You will develop a feel for air volume sufficient for current body activity pretty quickly, but that doesn’t mean you can’t continue to inhale when that overbought level is breached. The same idea applies to markets—you draw your overbought and oversold levels with the idea that they help you identify overextensions in price swings where probabilities start to shift in favor of price going in the opposite direction. However, you don’t base your trades solely on these levels because markets can keep going up or down much further, just like you can continue to inhale.

To tune your momentum indicator and its overbought and oversold levels for your market and your needs, you can adjust the period you’re using. The shorter the period in the indicator, the noisier it gets and the easier it oscillates between max and min values (of course, if there are max and min values on a particular indicator). The longer the period you use, the less noise there is (but with more lag), and it also becomes harder to reach max and min values. For instance, if you decide to change your default 14-period RSI to a 7-period RSI because you feel that its oscillation looks better for your purposes, it probably makes sense to widen the overbought and oversold boundaries from the default 70% and 30% to 75% and 25% or even 80% and 20%, to avoid oscillation noise triggering overbought/oversold conditions too often.

That said, be sure not to change your settings or indicators frequently or for minor reasons. Be consistent with your tools, as you train your brain to see markets through particular tools like lenses, enabling you to act when you meet a specific set of conditions. Without consistency, there are no proper conditions at all, and therefore, you don’t train your eye for anything. You wait for the market to come to you, not chasing the market to find trades.

Divergences

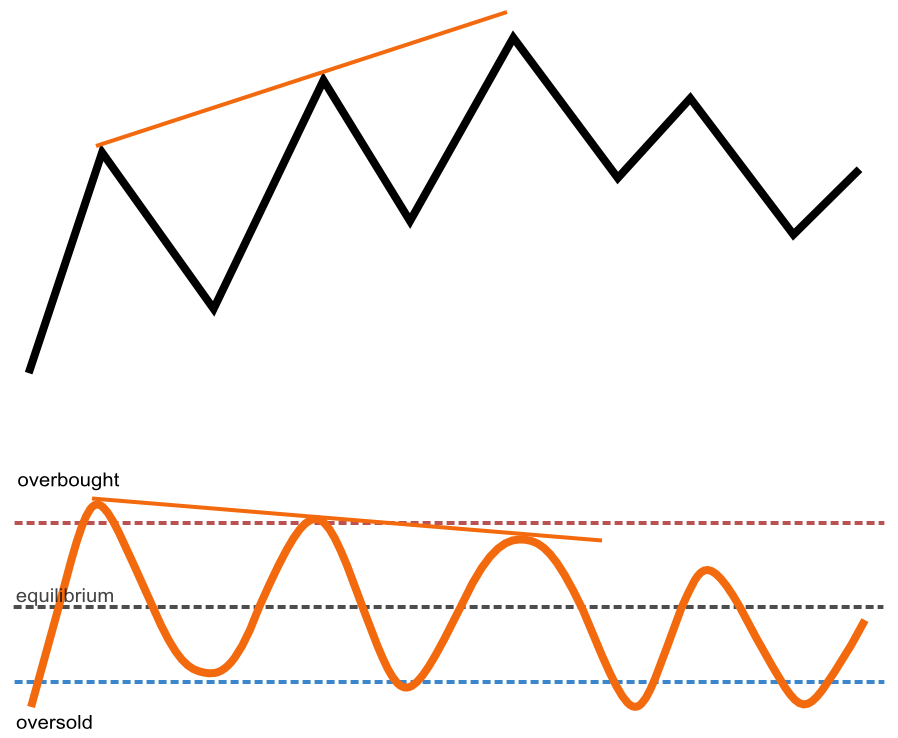

Usually, momentum turns ahead of the price, so when the market makes a higher high in an uptrend and your momentum indicator doesn’t make a new higher high, that is a divergence, and you should be more suspicious about that uptrend.

The opposite is true for downtrends. While these divergences are often valuable information, be careful—divergence is not a signal. The market can make swing after swing after swing in continuation of the trend, while the momentum indicator keeps showing you these divergences. Therefore, you need price confirmation to enter the trades.

Characteristics in bull and bear markets

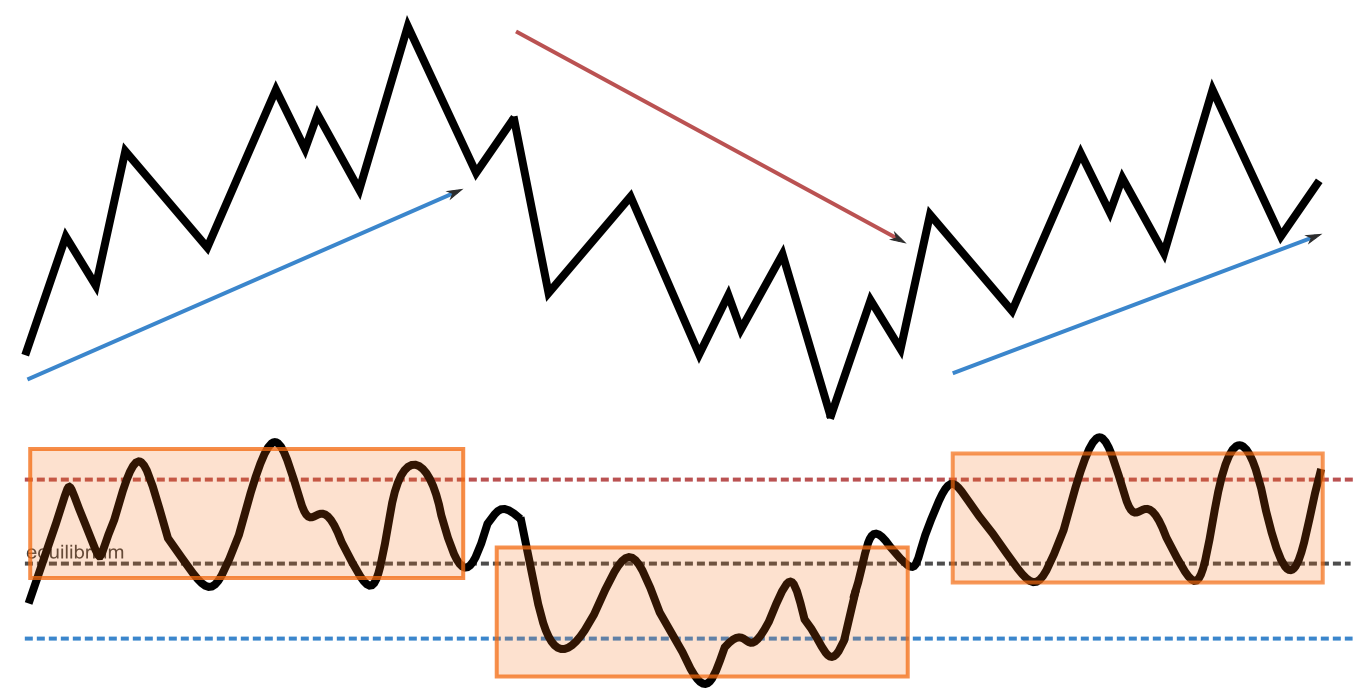

Oscillators behave slightly different in bull market and bear market, during bull market indicators have tendency to shift to the upside and during bear markets – to downside.

This has implications for overbought and oversold situations:

- Trend continuation. Let’s say your market is in an uptrend, and your thesis is that the uptrend will remain intact. Since you are in an uptrend, the market moves to the south during a pullback, but you look at the momentum indicator, and it clearly shows an oversold condition, which is rare in bull markets. This could mean the market is truly oversold, and the odds of an upswing from here are extremely high, especially if you can draw a trendline in your market’s uptrend and see that the oversold condition occurred when the pullback reached the trendline. The opposite is true for bear markets.

- Trend termination. Let’s say you are in an uptrend, and your thesis is that the uptrend should end. Your range of indicator values has shifted to the south, but you see a very strong oscillation down to oversold conditions, and that downswing clearly made a new low compared to recent indicator history. This could mean the market’s character has changed, especially if the price downswing made a lower low in market structure or clearly violated the trendline. The opposite is true for bear markets. It’s usually better to analyze this not with relative indicators like RSI or Stochastic, but rather with indicators that don’t have maximum and minimum values, such as MACD or ROC.

- Indecision. If, after that price downswing, the market makes an upswing and your momentum indicator moves from oversold to overbought with approximately the same oscillation magnitude as it did for the market downswing, this could indicate indecision, especially if it makes a new higher high or you see a failed test of a trendline. If sellers had taken control, the market would not be able to behave like that, so your thesis about the uptrend’s end should require more confirmation.

gl hf