News catalyst.

You should apply common sense when reading news catalysts. Common sense tells you that if earnings are up 1% and the stock gaps up 1% with relatively no volume, that’s probably not significant news. You want to see a gap of over 3% or more, and you want to see some trading volume to consider it in play when the market opens. Common sense also tells you that if revenues are up 1% and the stock gaps up 15%, you’re probably missing something, and you should check other news feeds for more comprehensive posts. It may also be that the stock’s short float is very high, and the news has provoked a short squeeze. If a clinical phase study missed the endpoint, you should research whether the biotech company has only one upcoming drug to sell or if they already have several drugs on the market. In the first case, the stock usually slips dramatically. Doing your research every day, listening to your mentor, and reading books and blogs will help you notice patterns like these:

- If a growth company misses on revenues, the stock can close down losing twice as much percentage as the company missed.

- If an SEC investigation is announced, investors will sell first and ask questions later, causing the stock to slip dramatically. However, don’t trade it if the company hasn’t commented on the investigation, because the stock market can be halted when the company issues a press release. If the stock is halted and you have a significant position, you can’t control your risk, and the open price may be significantly against you.

- Stocks with a lower float tend to move more ATRs, while stocks with a heavier float tend to move less during earnings.

- The street usually gives more attention to core business metrics. For growth companies, like Netflix in 2016, the subscription rate is very important. For Facebook, it’s mobile active users growth and mobile ad numbers. For Amazon, it’s the AWS numbers.

- If a drug’s clinical phase studies meet the endpoint, a biotech company usually closes near the high of the day (HOD) and moves many ATRs.

- The market lives in anticipation. You invest now to get profit in the future, so full-year guidance is more important than next-quarter guidance, and next-quarter guidance is more important than the actual earnings report.

Always remember that it’s not the fundamentals that are important—it’s people’s attitude toward the fundamentals that matters.

Stock selection.

Some trading schools will tell you to avoid stocks priced above $X or focus on trading penny stocks. Other trading schools will tell you it’s impossible to trade low-priced stocks because they move too little, so you should trade stocks priced over $20. One school may recommend trading at the open to catch bigger moves, while others will advise waiting 30 minutes if you are a novice trader. What they are trying to do is help you control your risk during execution. The real question when selecting a stock to trade is: can you control your risk while trying to capture your move? The answer lies in your execution skills, preferences, and, once again, common sense. For one person, it’s easier to trade 10,000 shares and catch a $0.25 move in a $5 stock. She patiently sits on the bids to get filled because she cannot afford to buy at the offer (a 1-cent spread costs $100, not including commissions) to avoid ruining the risk/reward ratio. For another person, it’s easier to catch $1 on 25 lots. He can instantly buy at the offer for that $40 stock, risking a maximum of 20 cents. He knows his slippage won’t exceed 15 cents, based on the spread, trading volume, time of day, and his intuition. These guidelines can help you create your own stock pool:

- A $1.5 move in a $10 stock represents a 15% gain, which is significant, while the same move in a $30 stock is only a 5% gain. It might be a good idea to monitor stocks priced above $15, as they tend to move more on earnings.

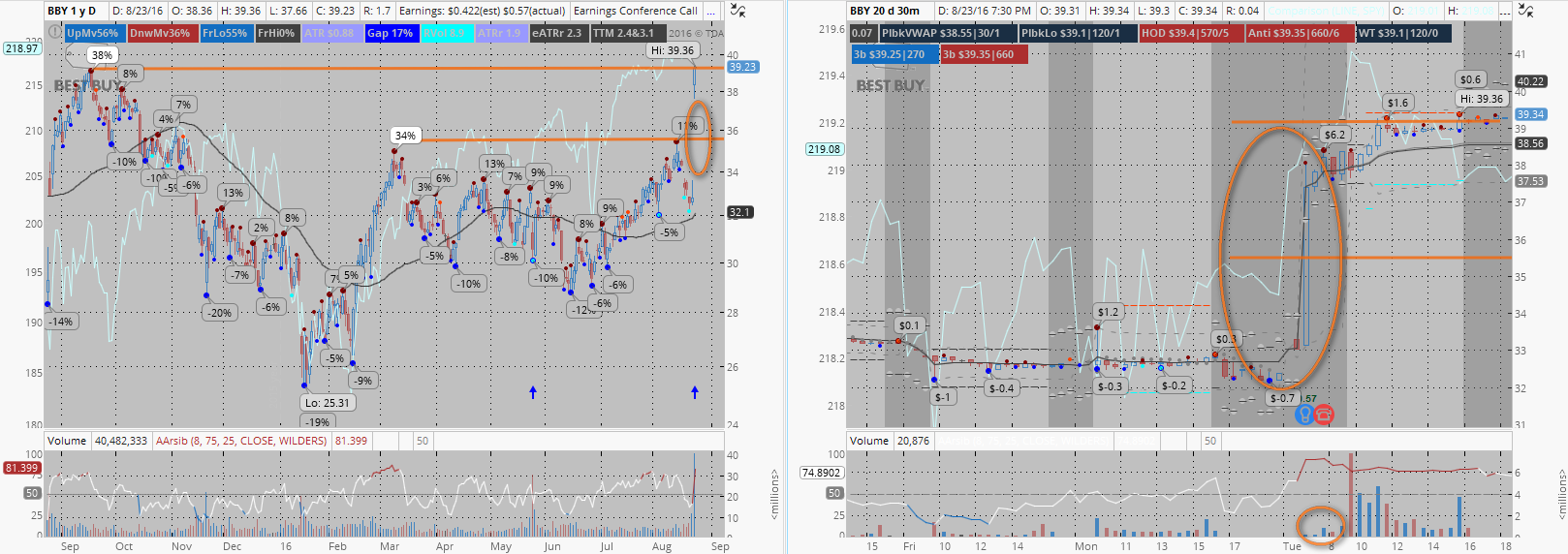

- Stocks usually move at least 2x their ATR (average true range) in response to proper news catalysts. Eliminating stocks with an ATR < $0.4-$0.5 will leave you with stocks that could potentially move more than $0.8-$1.

- Stocks in the $15-$50 range with an average daily volume (ADV) > 5 million shares will typically have a maximum slippage of 5 cents after 9:45 AM.

- If you expand your range to $15-$80 with ADV > 1 million shares after 9:35 AM, you may encounter larger spreads, with slippage exceeding 20 cents. You’ll need to manage this risk carefully. Let’s say you play setups with a risk/reward ratio of 1:5 and decide to go long against $50 (your stop is at $49.99), risking $100 in the following cases:

- You can go long at an average price of $50.03 with a maximum stop-loss slippage of 5 cents.

- You can go long at $50.03 with a maximum stop-loss slippage of 10 cents.

- You can go long at $50.05 with a maximum stop-loss slippage of 20 cents.

Based on these scenarios:

- In the first case, take 1,200 shares, where your total risk is 8 cents.

- In the second case, take 800 shares.

- In the third case, take only 400 shares.

If you buy 1,200 shares in the third case, you may lose $300. If you buy 400 shares in the first case, your potential profit is $32 × 5 = $160. Lack of experience can lead to poor position sizing, which, in turn, leads to bad risk management when trading $50-priced instruments.

- If you expand your range to $15-$80 with ADV > 1 million shares after 9:35 AM, you may encounter larger spreads, with slippage exceeding 20 cents. You’ll need to manage this risk carefully. Let’s say you play setups with a risk/reward ratio of 1:5 and decide to go long against $50 (your stop is at $49.99), risking $100 in the following cases:

- The noisier a stock tends to trade, the more checks you’ll want in your favor before committing to the trade. For example:

- Financial stocks: Avoid trading unless there is significant news and a major long-term level has been breached. Otherwise, market-making programs may stop you out too often before you catch your move.

- Commodity stocks: These often have arbitrage algorithms running, making them rarely trade cleanly.

- ADRs: These can also be challenging due to similar dynamics.

- Stocks priced over $100: It’s helpful to think of them as $10 stocks to focus on 10-cent resolution instead of 1 cent.

- Reading the tape: It’s possible to read the tape for stocks with ADV = 1-2 million, but for stocks trading tens of millions of shares on average, the tape becomes too messy.

gl hf