Failure Test

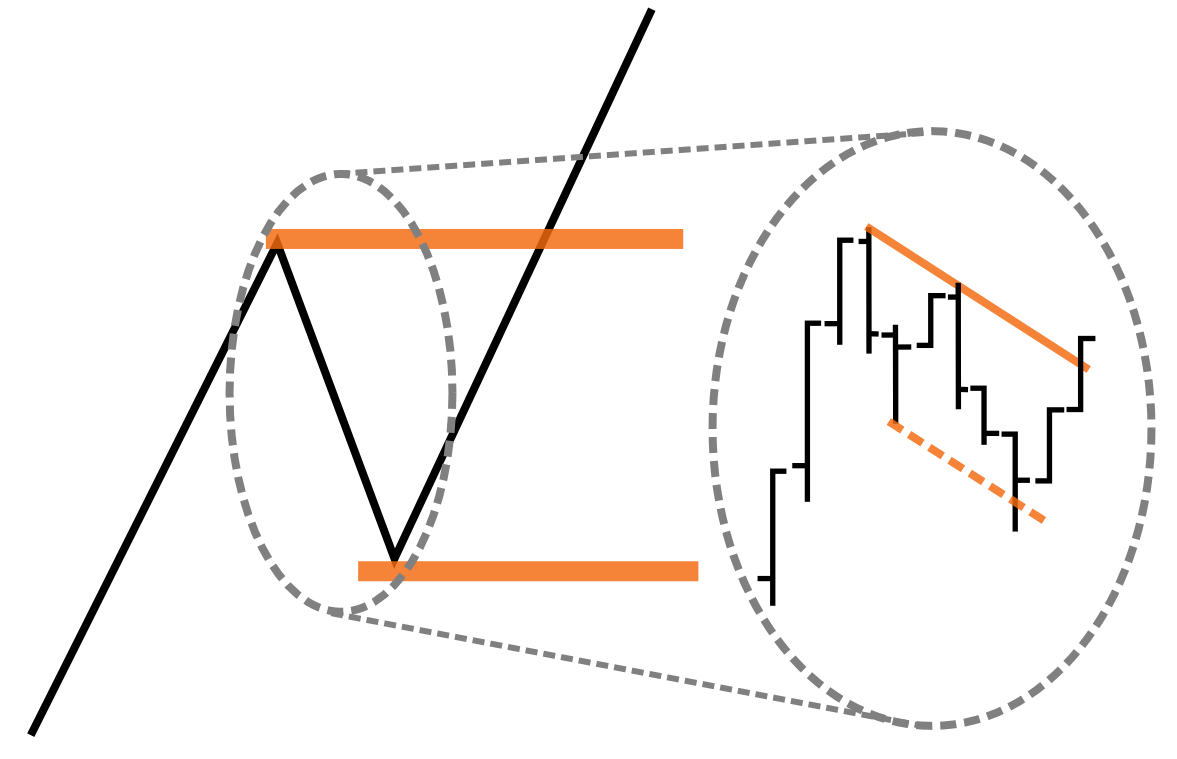

Trade Type: Support/resistance holding or trend termination.

Concept: Markets often probe beyond significant price levels to trigger stop orders and spark activity. However, these moves frequently lack genuine conviction and quickly fail, reversing once the stop orders are activated. Entering after such reversals provides excellent reward-to-risk potential with a clearly defined risk point.

Setup: The market should be overextended or otherwise poised for a reversal. The best examples of this trade typically occur in mature, extended trends and are often accompanied by momentum divergence on the trading time frame. Another common variation appears in extended consolidations just below resistance. While such consolidations usually suggest a high probability of breaking out into another trend leg, if the breakout fails, it traps many traders, adding momentum to a downside move from that level.

Trigger: For a short entry, the market initially trades above a clearly defined resistance level but then immediately reverses, closing back below the resistance on the same or the following bar. A short position is entered on the bar that closes back below the resistance level. This setup aligns with the classic Wyckoff spring or upthrust pattern, a principle developed nearly a century ago that remains effective today. Occasionally, the close back into range occurs on the next bar, highlighting that the market failed to sustain new price levels and quickly rejected them. In such cases, analyzing lower time frames can help determine whether the rejection was immediate or part of a pullback.

Stop: The stop-loss is straightforward: a hard stop is placed just beyond the extreme of the price test above the resistance level.

Pullback

Buying Support or Shorting Resistance

Trade Type: Trend continuation.

Concept: This strategy leverages countertrend pullbacks to enter the broader trend at a favorable price. Pullbacks can take various forms—flags, pennants, wedges, continuation triangles, and more—but their specific shape is less important than their function. At their core, these are continuation patterns within trends. The key is understanding the nature of the pattern, recognizing its purpose, and trading accordingly.

Setup: The primary condition for this trade is a trending market. For a valid setup, the preceding trend leg should match or exceed the strength of previous trend legs in the same direction, maintaining the overall pattern and avoiding signs of momentum divergence. Pullbacks can also be effective entries during trend transitions or following breakouts from trading ranges. Whether in a well-established trend or the early stages of a potential new trend, the setup leg must indicate momentum likely to lead to a continuation (impulse-retracement-impulse). A helpful approach is to identify conditions that contradict the trade, such as momentum divergence or overextension on higher time frames, which are typically prerequisites for countertrend trades. If no contradictory conditions are present, with-trend trades are well-supported. Once these foundational criteria are met, attention shifts to the pullback pattern itself. High-quality pullbacks generally feature reduced activity, evidenced by smaller bar ranges and the absence of significant countertrend momentum.

Trigger: The entry point involves buying near support at the bottom of the pullback or shorting near resistance at the top. A critical consideration is that support and resistance levels in pullback patterns often slope, making it essential to identify not just the level but also a clear trigger aligned with that level to confirm the entry.

There are two primary triggers for entering pullback trades:

- Break and Recovery of the Trend Line or Channel: This setup involves identifying a clean pullback, which may allow for a trend line to be drawn on both sides or within a parallel trend channel. The entry trigger occurs when the trend line or channel is breached, but prices quickly recover back above the trend line within a few bars. The concept behind this is that traders who bought during the pullback, expecting support to hold, are temporarily forced out of their positions by a drop below the support level. This “washout” creates a climactic reversal. Although this pattern often aligns with a climax visible on lower time frames, it is usually clear from the primary trading time frame, so examining lower time frames is not necessary in most cases.

- Buying Directly at Support: This trigger involves entering at the support level near the bottom of the pullback. However, executing this trade in real time can be challenging. Stop placement is particularly difficult because support levels often dip, triggering stops for weaker longs. The recovery from such a fakeout typically forms the first trigger mentioned above, making this entry more complex to execute effectively.

Traders should be cautious buying into pullbacks that repeatedly test support (three or more times). These patterns often signal an impending failure, particularly when accompanied by lower highs converging into the support level. Each successive bounce reflects waning buyer interest, increasing the probability of a breakdown.

The most favorable pullbacks occur as brief pauses within strong trends, characterized by sufficient market interest to prevent the pullback from lingering near support or resistance for too long. By focusing on these high-quality setups, traders increase their chances of success and avoid less reliable patterns.

Stop: There are two main approaches to placing stops in trading:

- Tight Stops Near the Pattern:

This approach places the stop as close as possible to the pattern, aiming to minimize the size of losing trades. There are two critical factors to consider:- Consistent Risk Sizing: All trades should be sized so that the potential loss is consistent, regardless of the stop’s proximity. The idea of a “low-risk” trade is misleading. Even when varying trade types, the risk level for trades within the same category should remain uniform.

- Higher Probability of Loss: Tight stops are more likely to be triggered. Considering the likelihood of losses, a very tight stop can often lead to higher overall losses in terms of expected value compared to stops placed farther away.

- Farther Stops with Adjustments:

An alternative and often preferable strategy involves placing stops farther from the pattern and adding a small, random “jitter” to their placement. This helps avoid the common mistake of positioning stops at obvious levels, which markets frequently target to trigger orders. By placing stops a few ticks or cents beyond these predictable levels, you reduce the chance of being unnecessarily stopped out by minor volatility. However, it’s important to acknowledge that additional volatility beyond the level may still lead to losses, as this is an inherent part of trading risk. The goal is to mitigate this risk through thoughtful stop placement.

Effective stop management is a dynamic process. Stops may be tightened significantly after the trade has progressed for a few bars or adjusted using a time-based stop if the trade does not perform as expected within a certain timeframe. Intelligent stop placement and active management are essential to balancing risk and maximizing trade potential.

Lower Time Frame Breakout

Trade Type: Trend Continuation and Breakout Blend

Concept: This trade setup aims to time entries into pullbacks by leveraging the momentum of a breakout on a lower time frame, aligning the trade with the market’s intended direction. This approach provides the advantage of momentum confirmation, but it comes at the cost of less optimal trade location. As a result, this method typically requires larger initial stops compared to entries near support or resistance, leading to lower reward-to-risk ratios.

Setup: This trade is a variation of the pullback concept and shares the same setup conditions as the previous pullback trade.

Trigger: The primary difference lies in the entry trigger, which in this case is based on a breakout of some structure within the pullback itself, typically most visible on a lower time frame. Some traders simplify this by trading breakouts of the previous bar on the trading time frame. However, this approach can be inconsistent because the high of the trading time frame bar may not correspond to a significant market level. It is essential to recognize that there is no inherent significance to a breakout of a bar’s high or low on any given time frame, as the chart is simply a visual representation of market dynamics. Paying attention to lower time frame price action often enables cleaner entries, although clear support and resistance levels can sometimes be identified on the trading time frame. For example, if two to three consecutive bars share the same high and the pullback fulfills all other criteria for a strong setup, a breakout above those highs can serve as an effective entry point.

Stops: For a lower time frame breakout trigger, many traders prefer very tight stops, assuming that if the breakout truly represents a critical tipping point, they can exit with a small loss if the move fails to develop. While this approach can be valid in certain contexts, small losses from tight stops can accumulate, and overly tight stops often fail to account for normal market noise. The key is to place stops intelligently—tight enough to limit risk but wide enough to respect market volatility. Stops should ideally be set just beyond the pivot point or where potential market-making activity might occur. Observing the breakout and the behavior of the first pullback after the breakout can provide opportunities to tighten stops appropriately. This balances the trade-off between reward-to-risk ratio and the probability of success, ensuring stops are both effective and practical.

Complex Pullback

Trade Type: Trend continuation.

Concept: Complex pullbacks, consisting of two distinct countertrend legs, are common in mature trends. Understanding these structures is crucial, as they often lead to losses for traders targeting simple pullbacks. It’s generally wise to avoid pullbacks after conditions suggesting a buying or selling climax. Strong countertrend momentum following such a climax typically confirms the end of the trend. However, the market may alternatively resolve an overextension through prolonged consolidation rather than an immediate trend reversal. Even after a potential climax, with-trend trades can still be viable if a complex consolidation develops. Often, the trend’s integrity is better evaluated on a higher time frame, as complex consolidations on the trading time frame frequently appear as simple consolidations on the higher time frame.

… LOG IN or SIGN UP (free) to see the rest of the content.