When a public company issues a press release or some other news becomes public, it can cause a stock to be “in play.” This is especially true if the news brings unexpected and significant information. Such news attracts more attention, increases trading volume, boosts volatility, and creates more opportunities. Many developing traders avoid stocks with breaking news, but in reality, stocks with fresh, unexpected, and clearly good or bad news are excellent trading vehicles!

These “in-play” stocks tend to have substantial and real order flow (causing the stock to trend) because financial institutions and large hedge funds must reassess their opinions about the stock based on the breaking news and reposition themselves accordingly. You are only as good as the market you trade, so it’s essential to learn how to trade stocks that move several average true daily ranges (ATR) on multiple average daily volumes (ADV). Trading stocks in play is especially beneficial during periods of low overall market volatility, as these stocks tend to have minimal correlation with indexes.

Catalysts to Watch For:

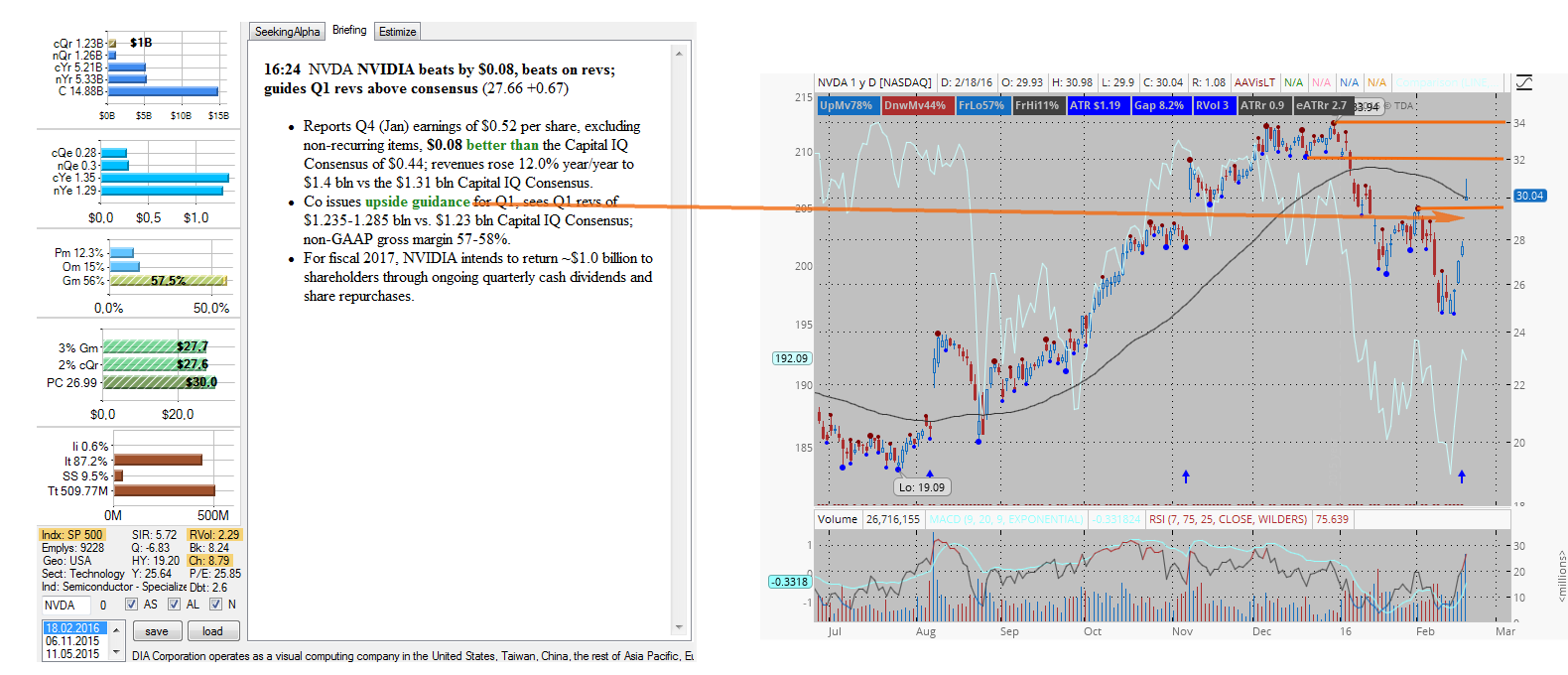

- A company revises revenue guidance higher or lower than Wall Street expectations.

- A company adjusts earnings guidance above or below expectations.

- Margins are significantly better or worse than anticipated.

- A new product launch that was unexpected.

- Gaining or losing market share.

- Phase II or Phase III clinical study results for an upcoming drug.

- Government investigations.

- Multiple upgrades or downgrades from top-tier banks (e.g., Goldman Sachs, Morgan Stanley, Citigroup).

- A stock with high short interest (over 25%) when news hits.

- Breaking out from multi-year consolidation.

Breaking news often emerges during after-hours or pre-market trading, resulting in price gaps when the market opens. Some traders avoid trading these gaps, believing the new information has already been factored in. However, the reality is that pre-market and after-hours trading sessions are typically too illiquid for institutions and hedge funds to execute large transactions. This creates opportunities for significant moves once regular trading hours begin.

gl hf