What’s the market?

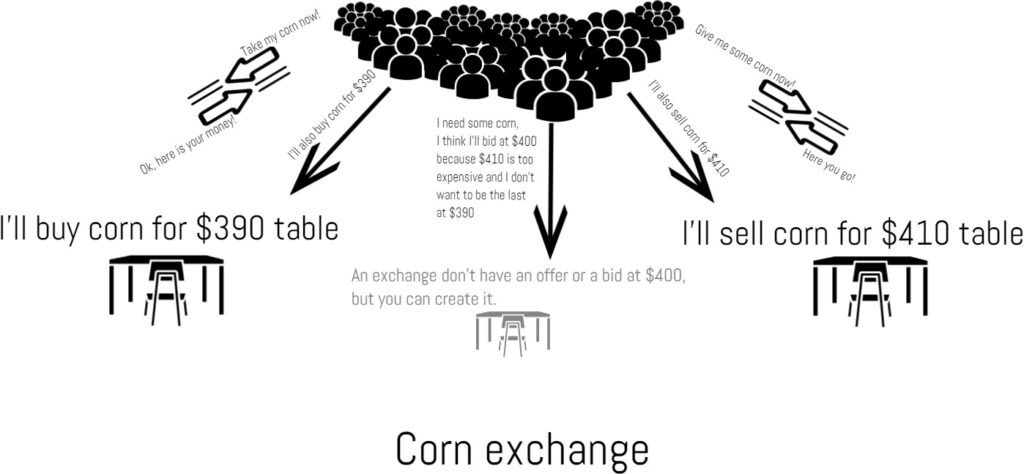

Markets (also known as exchanges) are essentially dedicated venues where people buy and sell assets. While each exchange may have its own rules, the fundamental principles are the same.

- Major U.S. exchanges: NYSE, NASDAQ, CME

In the example above, a person can place a bid at 400 in the corn market. But what else can they do? First what comes to mind is to create an offer at 400 if they have corn and don’t want to sell at the bid price, or to be the last one in the queue on the offer. However, there are actually several other actions that people can do in the markets:

-They can borrow some corn from another participant, promising to return it later, and then sell it in the market – this is called taking a short position.

-They can sign a contract with another participant agreeing to buy a certain amount of corn by a specific date – this is known as a futures (or forward) contract.

-They can sign a contract with another participant that gives them the option to buy a certain amount of corn by a specific date if they want to – this is called an option contract.

To prevent chaos from everyone signing custom contracts with one another, exchanges standardize futures and options contracts, creating a market for these standardized agreements.

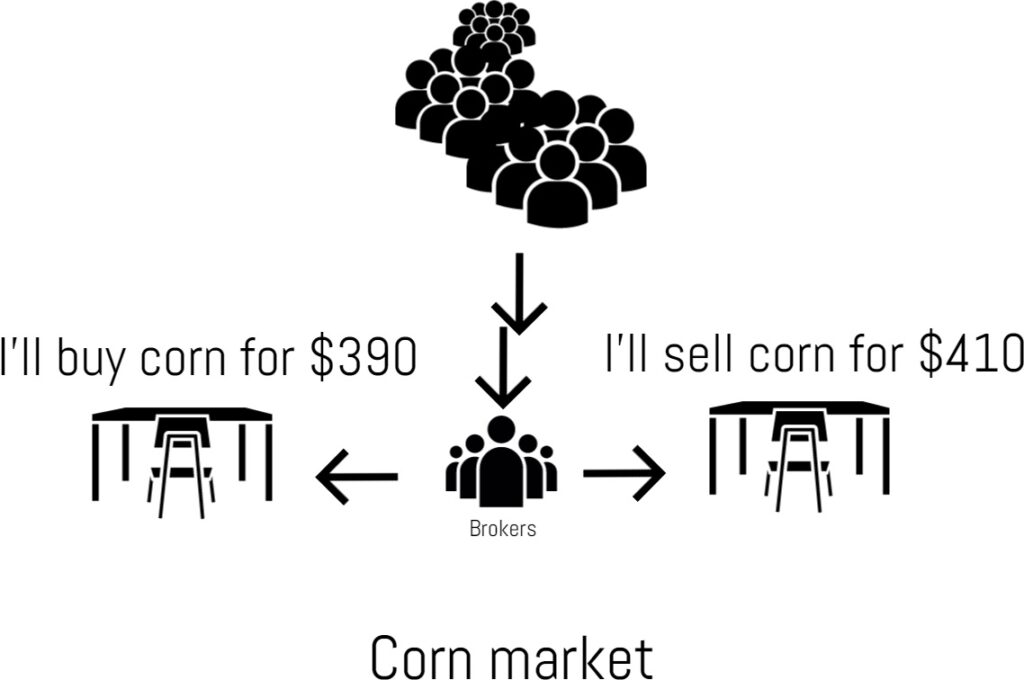

What’s a broker?

Actually, it’s not as simple as shown in the picture above – only licensed individuals (also known as brokers) can operate on exchanges. Since obtaining a license is costly, the average person uses brokerage services to buy or sell assets on exchanges. You send an order to your broker, who checks if it complies with exchange rules, and then places your order on the exchange.

- Major U.S. brokers: Interactive Brokers, TD Ameritrade, Fidelity, Etrade, Tradestation, Lightspeed.

Many brokers have access to all major exchanges, so to buy or sell assets, you simply need to sign up with a broker, provide your ID to open an account, transfer funds to your account, download their software, and you’re ready to trade.

There are plenty of information on the internet about what an exchange is, the world’s biggest exchanges, and brokers comparison, so let’s move on to more interesting details.

What they usually trade on the exchanges?

- Stocks (shares in companies).

- Futures – indexes and merchandise/commodities (I’m buying from you / selling you that thing by this price up to that date).

- Options – stocks, indexes and commodities/merchandise (I may buy from you / sell you that thing till that date).

- Exchange-Traded Funds – is a type of investment fund and exchange-traded product that holds a collection of assets such as stocks, bonds, or commodities.

- Currencies – like EUR/USD and BTC/USD

- Commodities – like corn, cattle, oil, gas and other energy, cotton, etc.

What do they mean by saying market is down X percent?

In the case of corn, it’s very simple—the corn is now X percent cheaper (often in comparison to the prior day’s closing price).

As for the stock market, it’s a bit more complicated. They create a pool of stocks and monitor that pool. The Dow Jones index has 30 stocks in its pool, while the S&P 500 has 500 stocks. Often, each stock has a weight coefficient, so the price action of Apple shares has much more influence on the S&P 500 index than shares of Starbucks or Activision Blizzard. When they say the S&P 500 is up 2%, it means that the pool is now 2% higher compared to the prior day’s close.

There are plenty of indexes—Nasdaq 100, Russell 2000, S&P 100, Russell 3000, Russell 1000, etc — but since the S&P 500 is based on the market capitalizations of 500 large companies listed on the NYSE and NASDAQ and deversified by sectors, it provides a very good representation of the U.S. stock market and serves as a bellwether for the U.S. economy.

What they mean by saying liquidity and volatility?

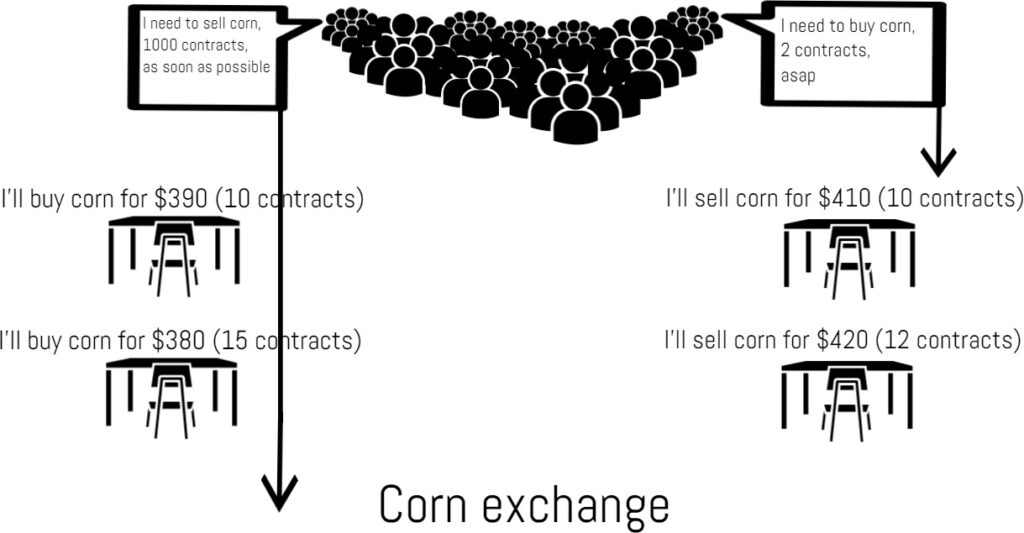

Liquidity is basically how much you can buy or sell without moving the market too much. Of course, that’s relative. For instance, take a look at that picture:

the market is pretty liquid for the guy on the right, but the guy on the left will have to sell at 390, then 380, then 370, and so on, until he gets rid of those 1,000 contracts—not a very liquid market for him.

As for volatility, that refers to how quickly the price changes in a market. Imagine that guy with 1,000 contracts pulls the trigger and starts selling all his contracts—the price will move dramatically, increasing market volatility.

As you might already understand, illiquid markets may be very volatile, and it’s much harder to control risk there (exiting your position at good prices). Remember, that’s relative—liquid markets can be volatile too. It’s beneficial when your market is liquid enough to control risk and volatile enough to catch good swings (directional moves).

gl hf